HOW TO E-FILING INCOME TAX RETURN

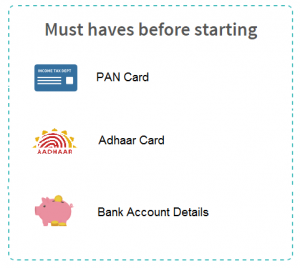

From 1st July onwards, it is mandatory to link your PAN with Aadhaar and

mention it in your IT returns. If you have applied for Aadhaar, you can

mention the enrollment number in your returns.

Read our Guide on how to link your PAN with Aadhaar.

Step 1.Get started

Login to your ClearTax account.

Login to your ClearTax account.

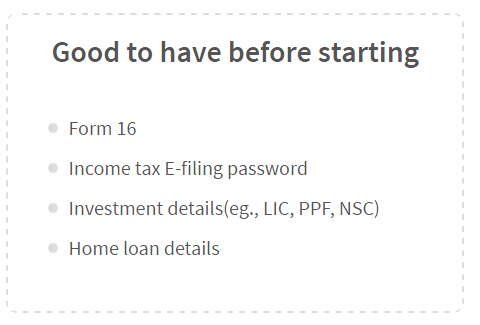

Click on ‘Upload Form 16 PDF’ if you have your Form 16 in PDF format.If

you do not have Form 16 in PDF format click on ‘Continue Here’

Step 2.Enter personal info

Enter your Name, PAN, DOB and Bank account details.

Enter your Name, PAN, DOB and Bank account details.

Step 3.Enter salary details

Fill in your salary, employee details (Name and TAN) and TDS.

Fill in your salary, employee details (Name and TAN) and TDS.

Step 4.Enter deduction details

Enter investment details under Section 80C(eg. LIC, PPF etc., and claim other tax benefits here.

Enter investment details under Section 80C(eg. LIC, PPF etc., and claim other tax benefits here.

Step 5.Add details of taxes paid

If you have non-salary income,eg. interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26AS

If you have non-salary income,eg. interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26AS

Step 6.E-file your return

If you see “Refund” or “No Tax Due” here, Click on proceed to E-Filing.You will get an acknowledgement number on the next screen.

If you see “Refund” or “No Tax Due” here, Click on proceed to E-Filing.You will get an acknowledgement number on the next screen.

Step 7: E-Verify

Once your return is file E-Verify your income tax return

Once your return is file E-Verify your income tax return